INCORPORATE THE RIGHT WAY AND PROTECT YOUR FUTURE !

INCORPORATE THE RIGHT WAY AND PROTECT YOUR FUTURE !

INCORPORATE THE RIGHT WAY AND PROTECT YOUR FUTURE !

By Matthew Leslie (San Diego CPA)

Incorporating can protect personal assets, create tax advantages and do a lot more for your business, but only when done right. Get expert advice that considers your assets, state laws and the reasons you’re incorporating. Besides all the other good reasons to incorporate, another great reason to incorporate is that you are no longer running your business as a sole proprietorship that some see as dealing with a smaller mom and pop shop; break away from the that view and with our help start presenting your company as an established corporation doing business in a bigger way.

We have been incorporating businesses for over 30 years and our service is second to none. For the entire process, from the initial steps to the end when your ready to fund the corporation in exchange for the corporate stock, we walk you through every step.

In our review of most incorporations done without a good professional or an experienced corporate attorney that are presented to us, we find that most lack the basic set-up essentials that should be completed from the start; let us help you and your business today; starting with your incorporation.

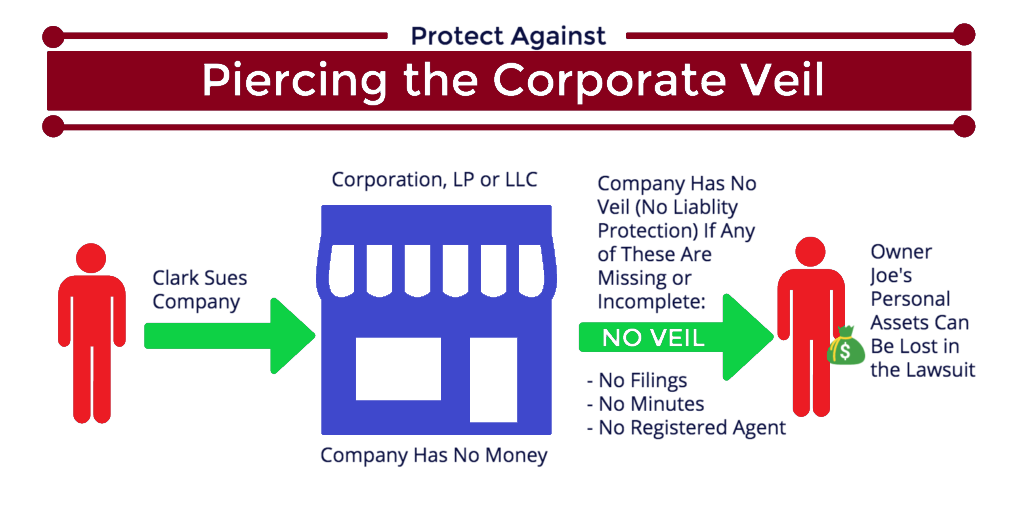

Call us today to set-up a Free half-hour consultation; we will answer all your questions and go over why cheap incorporation kits and services allow owners to make very costly mistakes, that in the end, will cost you the rightful protection that you sought in the first place. Here is a great example of what can easily happen:

Why is it essential for a Business to hire a good Certified Public Accountant or an experienced outside professional?

A good Certified Public Accountant (CPA) or business professional is like a really good partner, someone who is able to listen to your concerns and then offer good business advice. Their input can be invaluable to the business or medical practice success.

If you want a smooth running business, consider the following:

A good CPA has usually specialized in various business dealings during his/her career and can offer invaluable help, experience and knowledge when you need it.

They can also save your business or medical practice thousands of dollars by implementing more efficient routines for accounting, administration, payroll and human resource functions, thereby freeing up time for you and your employees to run your business or practice more effectively.

Your CPA should be able to help improve collection on accounts receivables; set-up follow-up routines to ensure no accounts due are left unsettled; which means more money to your business!

A good CPA can help with valuable advice for the business decisions you may be considering (i.e. expanding, employee issues, firing an employee, hiring outside help, etc.); which can help steer you in the right direction or give options to consider when making critical business decisions.

Not only can we provide helpful insights into what should be considered when making a major purchase, but also lay out the costs vs. the benefits to leasing, etc.

We can also help negotiate contacts, leases, mergers and/or any other business dealing that a business/practice owner is contemplating.

In addition, they can help safeguard your business assets and also set-up good internal controls to help prevent fraud and weaknesses in your administrative and accounting functions (you can see this posting on our insights page).

Your CPA should be able to save you money on your payroll taxes, year-end corporate tax returns and also make sure you do not get hit with penalties and late fees, etc.

A CPA firm should be able to help make you and your staff accounting/administrative duties much more effective and efficient; thereby increasing your bottom line!

These are just some of the areas a good Certified Public Accountant can help with.

Give us a call today at 619-464-1014 and learn how we can help you and your business. You’ll be glad you did.

We look forward to hearing from you.

Also consider the following questions:

Suspect you're paying too much for your bookkeeper or accounting services?

Are you new to the San Diego area or are you just looking for a Good CPA or Accountant?

Maybe you think your current accountant isn't doing a good job?

Let us help... give us a call today... the consultation is free.

Additional TIPS and ADVICE:

Never represent yourself before a governmental entity (i.e. IRS or Franchise Tax Board, etc.). Call us for our expert advice.

Let us show you how we can help today!

We also offer a guarantee for qualified companies: If we can’t show you how to save at least $2,000.00 a year, we will pay you $500.00... that’s how confident we are that we can help you and your business.

By Matthew Leslie (San Diego CPA)

Incorporating can protect personal assets, create tax advantages and do a lot more for your business, but only when done right. Get expert advice that considers your assets, state laws and the reasons you’re incorporating. Besides all the other good reasons to incorporate, another great reason to incorporate is that you are no longer running your business as a sole proprietorship that some see as dealing with a smaller mom and pop shop; break away from the that view and with our help start presenting your company as an established corporation doing business in a bigger way.

We have been incorporating businesses for over 30 years and our service is second to none. For the entire process, from the initial steps to the end when your ready to fund the corporation in exchange for the corporate stock, we walk you through every step.

In our review of most incorporations done without a good professional or an experienced corporate attorney that are presented to us, we find that most lack the basic set-up essentials that should be completed from the start; let us help you and your business today; starting with your incorporation.

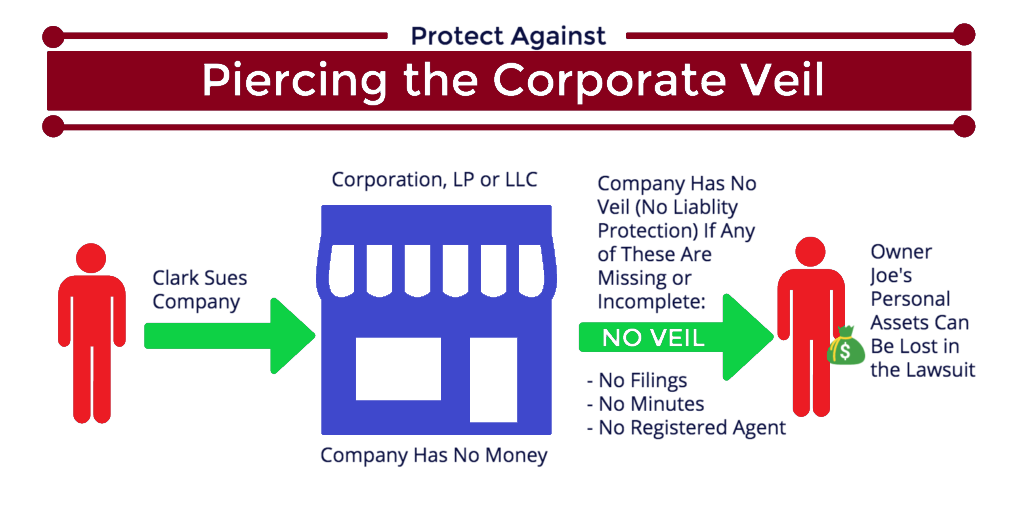

Call us today to set-up a Free half-hour consultation; we will answer all your questions and go over why cheap incorporation kits and services allow owners to make very costly mistakes, that in the end, will cost you the rightful protection that you sought in the first place. Here is a great example of what can easily happen:

Why is it essential for a Business to hire a good Certified Public Accountant or an experienced outside professional?

A good Certified Public Accountant (CPA) or business professional is like a really good partner, someone who is able to listen to your concerns and then offer good business advice. Their input can be invaluable to the business or medical practice success.

If you want a smooth running business, consider the following:

A good CPA has usually specialized in various business dealings during his/her career and can offer invaluable help, experience and knowledge when you need it.

They can also save your business or medical practice thousands of dollars by implementing more efficient routines for accounting, administration, payroll and human resource functions, thereby freeing up time for you and your employees to run your business or practice more effectively.

Your CPA should be able to help improve collection on accounts receivables; set-up follow-up routines to ensure no accounts due are left unsettled; which means more money to your business!

A good CPA can help with valuable advice for the business decisions you may be considering (i.e. expanding, employee issues, firing an

employee, hiring outside help, etc.); which can help steer you in the right direction or give options to consider when making critical

business decisions.

Not only can we provide helpful insights into what should be considered when making a major purchase, but also lay out the costs vs. the benefits to leasing, etc.

They can also help negotiate contacts, leases, mergers and/or any other business dealing that a business/practice owner is contemplating.

In addition, they can help safeguard your business assets and also set-up good internal controls to help prevent fraud and weaknesses in

your administrative and accounting functions (you can see this posting on our insights page).

Your CPA should be able to save you money on your payroll taxes, year-end corporate tax returns and also make sure you do not get hit

with penalties and late fees, etc.

They should be able to help make you and your staff accounting/administrative duties much more effective and efficient; thereby increasing your bottom line!

These are just some of the areas a good Certified Public Accountant can help with.

Give us a call today at 619-464-1014 and learn how we can help you and your business. You’ll be glad you did.

We look forward to hearing from you.

Also consider the following questions:

Suspect you're paying too much for your bookkeeper or accounting services?

Are you new to the San Diego area or are you just looking for a Good CPA or Accountant?

Maybe you think your current accountant isn't doing a good job?

Let us help... give us a call today... the consultation is free.

Additional TIPS and ADVICE:

Never represent yourself before a governmental entity (i.e. IRS or Franchise Tax Board, etc.). Call us for our expert advice.

Let us show you how we can help today!

We also offer a guarantee for qualified companies: If we can’t show you how to save at least $2,000.00 a year, we will pay you $500.00... that’s how confident we are that we can help you and your business.

By Matthew Leslie (San Diego CPA)

Incorporating can protect personal assets, create tax advantages and do a lot more for your business, but only when done right. Get expert advice that considers your assets, state laws and the reasons you’re incorporating. Besides all the other good reasons to incorporate, another great reason to incorporate is that you are no longer running your business as a sole proprietorship that some see as dealing with a smaller mom and pop shop; break away from the that view and with our help start presenting your company as an established corporation doing business in a bigger way.

We have been incorporating businesses for over 30 years and our service is second to none. For the entire process, from the initial steps to the end when your ready to fund the corporation in exchange for the corporate stock, we walk you through every step.

In our review of most incorporations done without a good professional or an experienced corporate attorney that are presented to us, we find that most lack the basic set-up essentials that should be completed from the start; let us help you and your business today; starting with your incorporation.

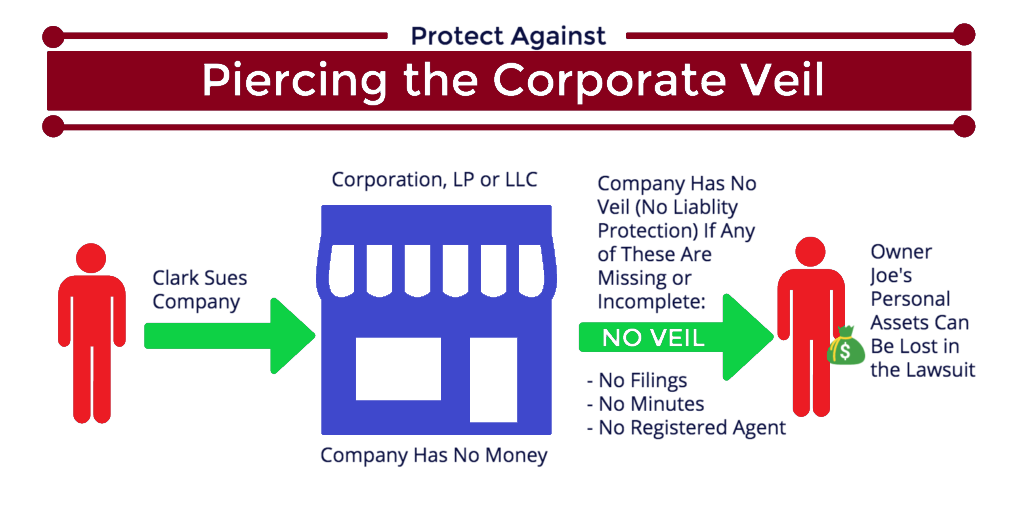

Call us today to set-up a Free half-hour consultation; we will answer all your questions and go over why cheap incorporation kits and services allow owners to make very costly mistakes, that in the end, will cost you the rightful protection that you sought in the first place. Here is a great example of what can easily happen:

Why is it essential for a Business to hire a good Certified Public Accountant or an experienced outside professional?

A good Certified Public Accountant (CPA) or business professional is like a really good partner, someone who is able to listen to your concerns and then offer good business advice. Their input can be invaluable to the business or medical practice success.

If you want a smooth running business, consider the following:

A good CPA has usually specialized in various business dealings during his/her career and can offer invaluable help, experience and knowledge when you need it.

They can also save your business or medical practice thousands of dollars by implementing more efficient routines for accounting, administration, payroll and human resource functions, thereby freeing up time for you and your employees to run your business or practice more effectively.

Your CPA should be able to help improve collection on accounts receivables; set-up follow-up routines to ensure no accounts due are left unsettled; which means more money to your business!

A good CPA can help with valuable advice for the business decisions you may be considering (i.e. expanding, employee issues, firing an

employee, hiring outside help, etc.); which can help steer you in the right direction or give options to consider when making critical

business decisions.

Not only can we provide helpful insights into what should be considered when making a major purchase, but also lay out the costs vs. the benefits to leasing, etc.

They can also help negotiate contacts, leases, mergers and/or any other business dealing that a business/practice owner is contemplating.

In addition, they can help safeguard your business assets and also set-up good internal controls to help prevent fraud and weaknesses in

your administrative and accounting functions (you can see this posting on our insights page).

Your CPA should be able to save you money on your payroll taxes, year-end corporate tax returns and also make sure you do not get hit

with penalties and late fees, etc.

They should be able to help make you and your staff accounting/administrative duties much more effective and efficient; thereby increasing your bottom line!

These are just some of the areas a good Certified Public Accountant can help with.

Give us a call today at 619-464-1014 and learn how we can help you and your business. You’ll be glad you did.

We look forward to hearing from you.

Also consider the following questions:

Suspect you're paying too much for your bookkeeper or accounting services?

Are you new to the San Diego area or are you just looking for a Good CPA or Accountant?

Maybe you think your current accountant isn't doing a good job?

Let us help... give us a call today... the consultation is free.

Additional TIPS and ADVICE:

Never represent yourself before a governmental entity (i.e. IRS or Franchise Tax Board, etc.). Call us for our expert advice.

Let us show you how we can help today!

We also offer a guarantee for qualified companies: If we can’t show you how to save at least $2,000.00 a year, we will pay you $500.00... that’s how confident we are that we can help you and your business.

Why is it essential for a Business to hire a good Certified Public Accountant or an experienced outside professional?

A good Certified Public Accountant (CPA) or business professional is like a really good partner, someone who is able to listen to your concerns and then offer good business advice. Their input can be invaluable to the business or medical practice success.

If you want a smooth running business, consider the following:

A good CPA has usually specialized in various business dealings during his/her career and can offer invaluable help, experience and knowledge when you need it.

They can also save your business or medical practice thousands of dollars by implementing more efficient routines for accounting, administration, payroll and human resource functions, thereby freeing up time for you and your employees to run your business or practice more effectively.

Your CPA should be able to help improve collection on accounts receivables; set-up follow-up routines to ensure no accounts due are left unsettled; which means more money to your business!

A good CPA can help with valuable advice for the business decisions you may be considering (i.e. expanding, employee issues, firing an

employee, hiring outside help, etc.); which can help steer you in the right direction or give options to consider when making critical

business decisions.

Not only can we provide helpful insights into what should be considered when making a major purchase, but also lay out the costs vs. the benefits to leasing, etc.

They can also help negotiate contacts, leases, mergers and/or any other business dealing that a business/practice owner is contemplating.

In addition, they can help safeguard your business assets and also set-up good internal controls to help prevent fraud and weaknesses in

your administrative and accounting functions (you can see this posting on our insights page).

Your CPA should be able to save you money on your payroll taxes, year-end corporate tax returns and also make sure you do not get hit

with penalties and late fees, etc.

They should be able to help make you and your staff accounting/administrative duties much more effective and efficient; thereby increasing your bottom line!

These are just some of the areas a good Certified Public Accountant can help with.

Give us a call today at 619-464-1014 and learn how we can help you and your business. You’ll be glad you did.

We look forward to hearing from you.

Also consider the following questions:

Suspect you're paying too much for your bookkeeper or accounting services?

Are you new to the San Diego area or are you just looking for a Good CPA or Accountant?

Maybe you think your current accountant isn't doing a good job?

Let us help... give us a call today... the consultation is free.

Additional TIPS and ADVICE:

Never represent yourself before a governmental entity (i.e. IRS or Franchise Tax Board, etc.). Call us for our expert advice.

Let us show you how we can help today!

We also offer a guarantee for qualified companies: If we can’t show you how to save at least $2,000.00 a year, we will pay you $500.00... that’s how confident we are that we can help you and your business.

Let our experience and expertise help you today. . .

We would be happy to help.

Give us a Call for your Free half-hour consultation. . .

You’ll be glad you did!

Let our experience and expertise help you today. . .

We would be happy to help.

Give us a Call for your Free half-hour consultation. . .

You’ll be glad you did!

Let our experience and expertise help you today. . .

We would be happy to help.

Give us a Call for your Free half-hour consultation. . .

You’ll be glad you did!

“Never Underestimate the Value Of An Experienced Certified Public Accountant (CPA).”

Please give us a today at 6 1 9 – 4 6 4 – 1 0 1 5.

“Never Underestimate the Value Of An Experienced Certified Public Accountant (CPA).”

Please give us a today at 6 1 9 – 4 6 4 – 1 0 1 5.

“Never Underestimate the Value Of An Experienced Certified Public Accountant (CPA).”

Please give us a today at 6 1 9 – 4 6 4 – 1 0 1 5.